what is stamp duty malaysia

4250 housing units worth RM358mil will be built under the Rumah Mesra Rakyat program. The empty string is the special case where the sequence has length zero so there are no symbols in the string.

Setem Hasil Stamp Duty Shopee Malaysia

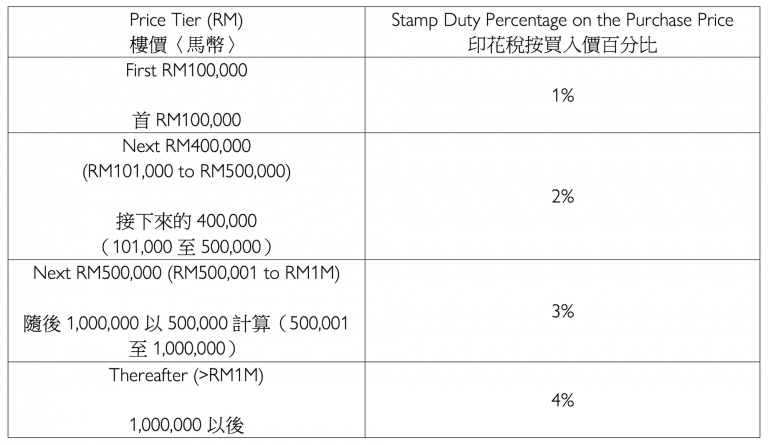

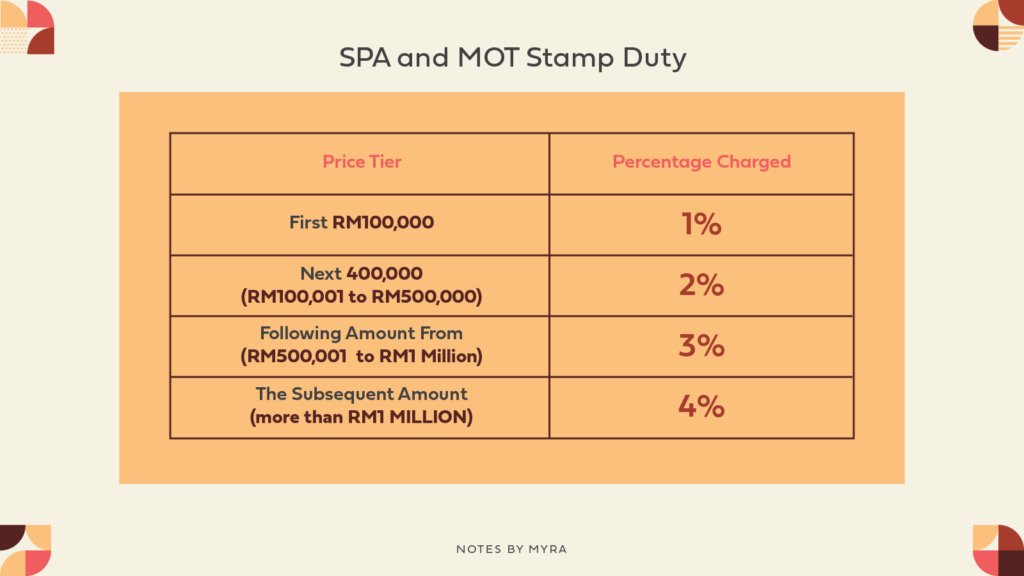

For First RM100000 RM100000 Stamp duty Fee 2.

. To know how much down payment lawyer fees and stamp duty needed are so. Stamp Duty Land Tax is a tax paid to HMRC when you buy houses flats and other land and buildings over a certain price in the UK. The tax is also paid by buyers from overseas non-UK residents at a 2 surcharge when buying property in the UK.

Stamp duty is the tax you pay your state or territory government when buying a property. Buyers will be sent this in an email sometime. Formally a string is a finite ordered sequence of characters such as letters digits or spaces.

Its calculated on a sliding scale so the more expensive the property the more stamp duty youll pay. Stamp Duty Land Tax SDLT is paid when you purchase property or land over a certain price in England and Northern Ireland. Unfortunately home buyers who plan to live in the property they buy cannot claim stamp duty as a tax deduction.

There is no stamp duty Tax applied to the first 250000. For some people buying a home is a significant milestone that tops many peoples lifetime to-do lists. Legal Fees Stamp Duty Calculation 2022 When Buying A House In Malaysia.

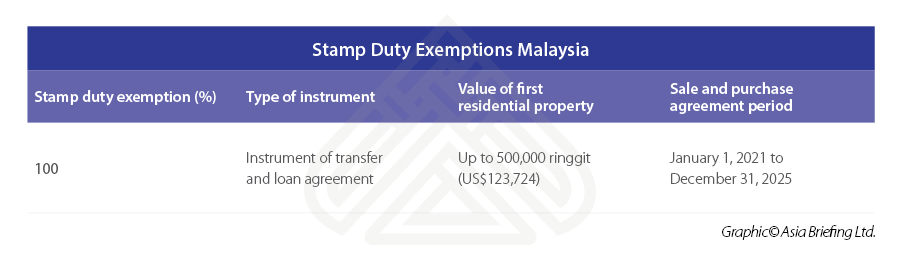

Stamp duty is the governments charge levied on different property transactions. Its minister Datuk Seri Reezal Merican Naina Merican said that for now full stamp duty exemption is only for first-time homeowners of properties priced RM500000 and below through the Keluarga Malaysia Home Ownership Initiative i-MILIKI while houses priced above RM500000 to RM1 million are given a 50 stamp duty exemption. You need to pay a stamp duty when you buy a property and also when you go in for a rental agreement.

The 100 stamp duty exemption for first-time homeowners remains applicable for properties priced RM500000 and below through the Keluarga Malaysia Home Ownership Initiative i-Miliki initiative from June 1 2022 to December 2023. The stamp duty rate will depend on factors such as the value of the property if it is your primary residence and your residency status. As such the government has made it a compulsory tax-paying when buying or transferring a house in Malaysia.

Stamp Duty Malaysia On A Loan Agreement Its also important to factor in the stamp duty owed for any loan agreement which may be entered into as part of a property purchase. Stamp duty is chargeable on instruments and not on transactions. Just as the stamp duty rate varies from state to state so does the timeframe in which people need to pay it.

Stamp duty is payable under Section 3 of the Indian Stamp Act 1899. Free shipping for many products. 10c Airmail Rate Cover to Barbados - Opened by Censor at the best online prices at eBay.

KUALA LUMPUR Oct 7 Individuals wishing to transfer their deed of assignment to their family members will only now need to pay a fixed rate of RM10 stamp duty next year onwards Finance Minister Datuk Seri Tengku Zafrul Abdul Aziz said today. However what you plan to do with the property also affects the amount youll pay. What are the changes to Stamp Duty when buying a UK second home or buy to let in the UK from 1st April 2016.

The calculation formula for Legal Fee Stamp Duty is fixed as they are governed by law. Stamp duty Fee 1. First-time homebuyers will get a stamp duty exemption on the instrument of transfer and loan agreement under the Keluarga Malaysia Home Ownership Initiative i-MILIKI says Datuk.

Under plans announced last month no stamp duty needs to be paid on the first 250000 of a property up from the previous 125000 threshold. Heres your guide to when a stamp duty tax deduction applies. Stamp Duty applies when you buy a freehold property buy a new or existing leasehold buy property through a shared ownership scheme or are transferred property in exchange for payment.

The stamp duty is free if. Get the latest international news and world events from Asia Europe the Middle East and more. If a transaction can be effected without creating an instrument of transfer no duty is payable.

The cost of stamp duty depends on the value of the property. Stamp Duty Calculation Malaysia 2020 And Stamp Duty Malaysia Exemption. First-time buyers will not pay any stamp duty on the first 425000 up from 300000 following the mini-Budget and the value of any property on which they can claim this relief has risen to 625000 from 500000.

Also read all about income tax provisions for TDS on rent. In unveiling Budget 2023 Tengku Zafrul said the new. When do you have to pay stamp duty.

Stamp Duty is revenue to the state and the federal government to run or operate the state or our country. Stamp duty is a tax on a property transaction that is charged by each state and territory the amounts can and do vary. From U-turn to U-turn to all but completely axing the mini-budget only a 13bn national insurance cut and a 15bn stamp duty cut survived the chancellor Jeremy Hunts announcement on Monday.

1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400. Purchasing and hunting for a house can be an exciting and stressful experience. RM100001 To RM300000 RM400000 Total stamp duty must pay is RM500000 So this is the total stamp duty then you can add legal fees disbursement fees valuation fees and other fees to estimate how much the cost of buying the house.

Whats the point of stamp duty. The state government has a general rate of stamp duty which applies to investment property. When the instruments are executed outside Malaysia they.

Malaysia will raise the stamp duty exemption to 75 from 50 on first home purchases Finance Minister Zafrul Aziz said in a budget speech to parliament on Friday. From the 1st April 2016 anyone purchasing a property in addition to their main home will pay an additional 3 SDLT for the first 125000 and 5 instead of 2 on the portion between 125001 and 250000 and 8 on the amount above 250001. The stamp duty for a tenancy agreement in Malaysia is calculated as the following.

Find many great new used options and get the best deals for 1943 Canada -Toronto Ont. Tenancy agreement between 1 to 3 years RM2 for every RM250 of the annual rent above RM2400. Calculate Stamp Duty Legal Fees for property sales purchase mortgage loan refinance in Malaysia.

The stamp duty for the SPA is only RM10 per copy while the stamp duty for MOT and DOA is calculated according to a fee structure of 1 to 4. Calculate now and get free quotation. ACT payable within 28 days of settlement purchasers must pay stamp duty within 14 days of receiving a Notice of Assessment from Access Canberra.

Can owner-occupiers claim stamp duty. The stamp duty is free if the annual rental is below RM2400. Calculate the stamp duty you may have to pay on your property using our tool.

Stamp duty on rental agreements. The rates are different for first-time buyers. But remember if you are a first home buyer many States and Territories offer.

Home Malaysia Law Firm Malaysia Law Statutes Legal Fee Stamp Duty for Sale Purchase Agreement Loan. Instruments executed in Malaysia which are chargeable with duty must be stamped within 30 days from the date of execution. What are the new rates of Stamp Duty Land Tax Stamp Duty for non-UK residents from 1st April 2021.

Mot And Stamp Duty In Malaysia Maxland Real Estate Agency

Malaysia Budget 2019 A Boon To First Time Homebuyers And The Affordable Housing Market Re Talk Asia

What Is Stamp Duty Everything To Know About Malaysia Stamp Duty

What Is Stamp Duty Everything To Know About Malaysia Stamp Duty

What To Remember About Stamp Duty In Malaysia

外國人在大馬置業費用 Jade Land Properties 翡翠島物業

Stamp Duty Exemptions Malaysia Asean Business News

Stamp Duty On Mot Stamp Duty Calculator Malaysia Malaysiacalculator Com

How Much Does The Stamp Duty For Your New Home Cost

Pdf Factoring And Stamp Duty In Singapore And Malaysia

Intraday Traders Most Affected By Stamp Duty Hike The Edge Markets

Review Budget 2020 Stamp Duty Real Property Gain Tax Ecovis Malaysia

How Much Does It Cost For Stamp Duty For Tenancy Agreement In Malaysia Property Malaysia

I B Malaysia Revenue Duty Stamp 10 Asia Malaysia Stamp Hipstamp

Ministry Of Finance Suspends Stamp Duty On Native Title Transactions Borneo Today

Stamp Duty Exemption How To Save Money Property Investments Malaysia

Upfront Costs Of Purchasing A Home In Malaysia Propsocial

Is There A Hidden Advantage Of Buying Your Property Now Lexushome

Stamping A Contract Is An Unstamped Contract Valid

0 Response to "what is stamp duty malaysia"

Post a Comment